The 15-Second Trick For Insurance

Unknown Facts About Insurance

Table of ContentsWhat Does Insurance Mean?Getting The Insurance To WorkThe smart Trick of Insurance That Nobody is Talking AboutSome Of Insurance

Your vehicle insurance policy will certainly pay out and make you whole. Your insurance might not cover enough damage in that situation.These individuals are commonly entrusted placing clinical bills that they are forced to pay out of their own pocket. This can bring about financial destroy, all since of a few other person's negligence. If the injured individual carries without insurance vehicle driver protection, they will have an insurance coverage policy that will certainly cover their medical bills, shed earnings, discomfort and also suffering, as well as any other problems they endured as a result of the electric motor lorry crash.

This would be practical in a situation where the at-fault parties lug very little physical injury protection (i. e. $10,000. 00) and also the harmed person's injuries as well as damages much exceed [that amount] The without insurance driver plan would tip in and supply the extra funds to pay for the problems that run in excess of the very little physical injury policy.

According to FEMA, 5 inches of water in a residence will trigger greater than $11,000 worth of problems. Colby Hager, proprietor of I am a property professional that acquires homes and also owns as well as handles rental residential or commercial properties. As somebody that takes care of rental residential or commercial properties, one usually neglected insurance policy requirement is renters insurance policy.

Insurance Things To Know Before You Buy

Renters' valuables are not covered by the owners' property insurance coverage. In case of a flood, all-natural catastrophe, theft, fire, or various other incidents, the renters' belongings would go to risk. Usually speaking, a renters plan is relatively affordable and also can offer a lot of peace of mind should an accident or other event occur.

If your pet is ever before in a crash or gets ill, it will certainly be a great thing to have. Some significant surgeries and hospitalizations for health problem can be extremely expensive. Animal insurance coverage can aid your $2,000 to $3,000 dollar costs decrease to a few hundred. When life occurs, make certain you're covered.

All about Insurance

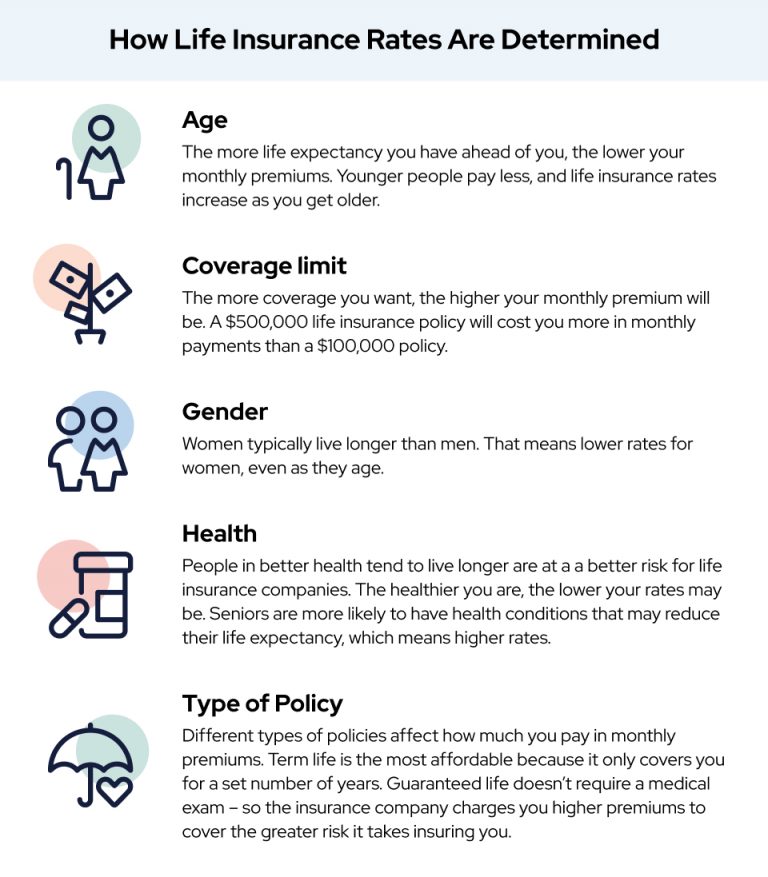

Jason Fisher is the founder as well as CEO of, among the nation's biggest as well as independent consumer sources forever insurance coverage. Licensed in greater than 30 states, Fisher has a particular passion as well as experience in estate planning, service continuation strategies, and also other sophisticated cases. It's his objective to offer an individualized approach to recognizing life insurance coverage, whether working straight with customers or offering the system for them to shop individually.

An HMO may require you to live or function in its solution area to be qualified for insurance coverage. HMOs typically give incorporated treatment and emphasis on have a peek at these guys avoidance as well as health. A sort of plan where you pay less if you utilize medical professionals, health centers, and also other wellness care carriers that come from the plan's network.

A sort of wellness strategy where you pay less if you make use of service providers in the strategy's network. You can make use of medical professionals, healthcare facilities, and also providers outside of the network without a referral for an added price. Get more info on what you ought to learn about company networks (PDF). See our Oral insurance coverage in the Marketplace web page to read more concerning options offered to you.

Insurance policy supplies comfort against the unexpected. You can locate a plan to cover virtually anything, but some are much more crucial than others. Everything depends on your requirements. As you map out your future, these 4 kinds of insurance policy must be securely on your radar. 1. Car Insurance Vehicle insurance policy is critical if you drive.

The Best Strategy To Use For Insurance

2. House Insurance For lots of people, a residence is their biggest property. Home insurance coverage secures you by offering you a monetary safety and security web when damages takes place. If you have a mortgage, your loan provider probably needs a plan, but if you don't get your own, your loan provider can get it for you and also send you the bill.

Medical Insurance Health insurance coverage is among one of the most important types. Your great health and wellness is what allows you to work, Get More Info make money, and also delight in life. What if you were to develop a major illness or have a mishap without being insured? You may locate yourself not able to obtain therapy, or forced to pay huge clinical costs.

You Might Want Impairment Insurance Coverage, Too "In contrast to what many individuals assume, their house or auto is not their best asset. Rather, it is their ability to earn a revenue. Many experts do not insure the chance of a disability," claimed John Barnes, CFP and owner of My Family Life Insurance. Traveling insurance policy is typically a temporary plan that you get just for the period of a journey, especially one outside of the united state. It consists of insurance coverage for medical care that could not be covered by your insurance coverage and also emergency situation medical transport back into the U.S. if you were to drop sick or be harmed overseas.